PART B: Background and Analysis

Establishment of the Child Support Review

On 29 July 2004, the Prime Minister, the Hon. John Howard MP, announced the Government’s response to the Report of the House of Representatives Standing Committee on Family and Community Affairs on the Inquiry into Child Custody Arrangements in the Event of Family Separation. One aspect of that response was to adopt the Report’s recommendation that the Government should establish a Taskforce to provide advice on whether particular changes to the Child Support Scheme are warranted.

The Minister for Children and Youth Affairs, the Hon. Larry Anthony MP, announced the establishment of the Taskforce and Reference Group on 16 August 2004. The Terms of Reference are given at the beginning of the Summary.

How the Taskforce conducted the Review

The main role of the Taskforce was to examine the formula used to calculate liabilities for child support and to consider a number of other issues arising out of the Government’s response to the House of Representatives Standing Committee on Family and Community Affairs’ Report, Every Picture Tells a Story (December 2003).

To fulfil this role, the Taskforce:

- analysed the submissions on child support made to the House of Representatives Standing Committee on Family and Community Affairs in 2003;

- analysed issues raised in Ministerial correspondence and unsolicited submissions to the Taskforce;

- consulted the Reference Group on issues to consider;

- reviewed the research on the costs of children both in Australia and overseas;

- conducted new research on the costs of children using three different approaches;

- examined the current impact of the Scheme on the living standards of both resident and non-resident parents;

- examined the child support systems of other countries and in particular, new approaches to child support since Australia developed its Scheme;

- consulted overseas experts on child support;

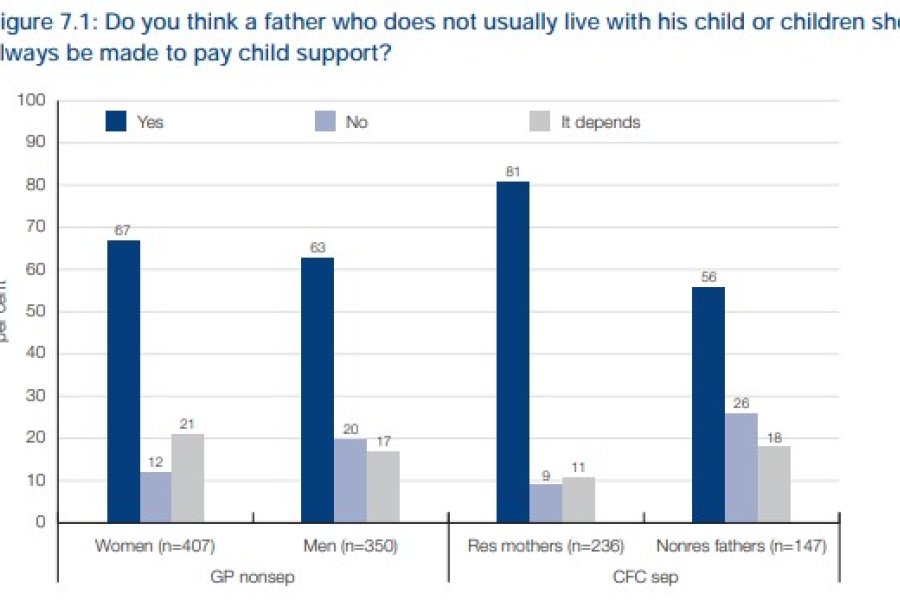

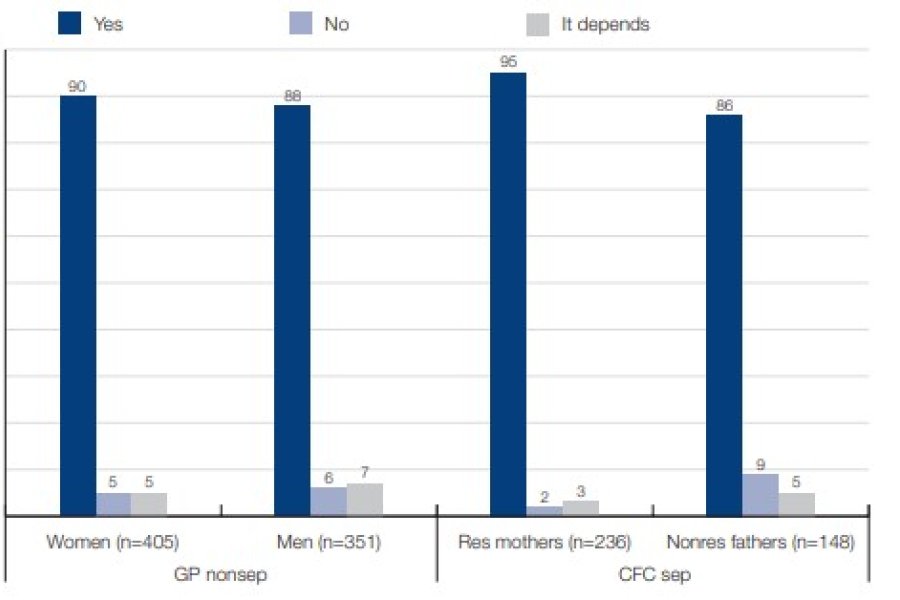

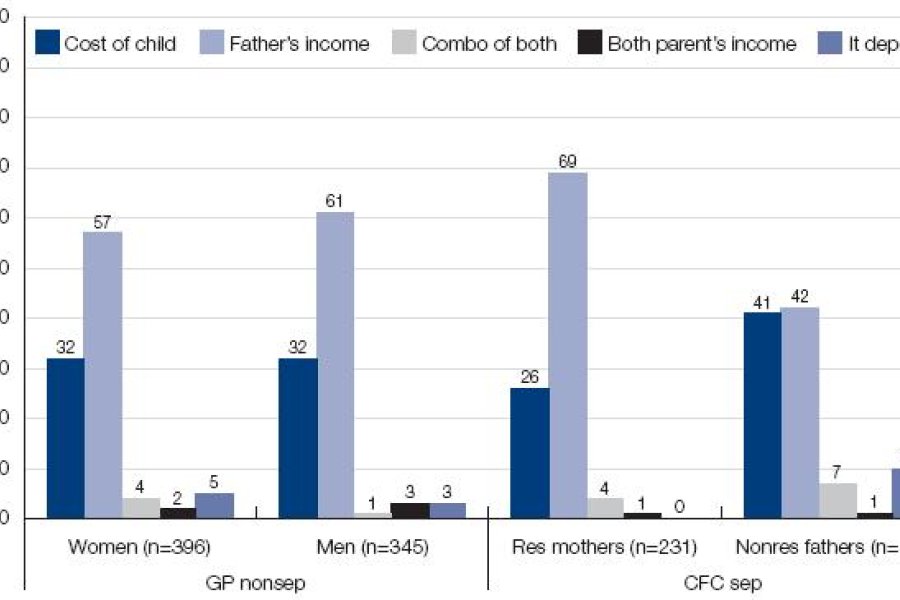

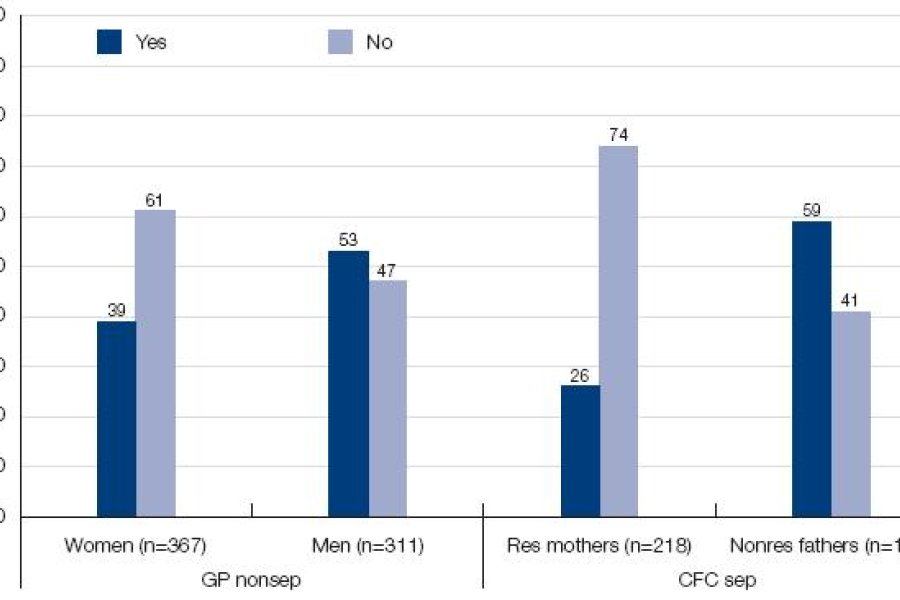

- commissioned the Australian Institute of Family Studies to conduct a survey of community attitudes towards child support;

- considered the interaction of the Child Support Scheme with Family Tax Benefit (FTB) and income support payments;

- consulted the Reference Group and other stakeholders on proposals for change;

- tested the proposals using a computer model that examined their impact for a range of different families; and

- consulted the Child Support Agency (CSA) on the feasibility of implementing the proposed new approach.

Papers containing the research underpinning the Taskforce’s findings are published in Volume 2 of this Report.

In analysing the costs of children, the Taskforce considered both the costs of children in intact families and the costs of children when parents live apart. Another major part of the work of the Taskforce required the analysis of the operation of the existing Child Support Scheme and proposed alternatives, and their interaction with the tax and income support systems. The National Centre for Social and Economic Modelling (NATSEM) at the University of Canberra was commissioned to develop a detailed model for this purpose. This was a complex task, but this microsimulation model and the extension of NATSEM’s population model (STINMOD) provide invaluable tools for future policy analysis and development. They enable the modelling of alternative policies to show outcomes for both individual families and the general population.

Submissions were not called for because all submissions presented to the House of Representatives Standing Committee on Family and Community Affairs in 2003 were available to the Taskforce. The Taskforce considered any unsolicited letters sent to it by members of the public during the course of its work.

What was not in the Terms of Reference

It is important also to state what was not in the Terms of Reference. In submissions to the House of Representatives Standing Committee on Family and Community Affairs, people raised a number of different concerns. Most of them were related to the operation of the formula. Others concerned aspects of the work of the CSA.

The Taskforce was not asked to examine issues concerning the administration of the Child Support Scheme. The CSA is now under the responsibility of the Minister for Human Services, the Hon. Joe Hockey MP.

The Taskforce was also not asked to consider aspects of the Family Law Act 1975 concerning parenting after separation. Many people who made submissions to the Parliamentary Inquiry were concerned that the Government had an administrative system in place to enforce the payment of child support but did not do enough to ensure that non-resident parents could see their children when the courts had made orders providing for regular contact. This is a very important issue, but it is one being addressed by other reforms that the Government has announced in its response to the Report of the House of Representatives Standing Committee on Family and Community Affairs—in particular, changes to the Family Law Act, the establishment of Family Relationship Centres, and the expansion of the Contact Orders program across the country.

Issues concerning the Family Law Act, including the enforcement of contact orders, are a matter for the Attorney-General, the Hon. Phillip Ruddock MP, and are outside the Terms of Reference of this Taskforce.

The context of the Child Support Review—reforming the family law system

While the Taskforce has focussed upon the issues that it was asked by the Government to address, it has done so with an awareness of the other initiatives that are taking place to reform family law and to enhance the counselling and dispute resolution programs that support parents who do not live together because of relationship breakdown. The Child Support Scheme is only one part of a broader system to ensure that both parents share in the responsibility for their children after separation and help their children to achieve their full potential as the adults of the future.

In particular, the Taskforce and the Reference Group have been motivated by a concern for the best interests of children whose parents are not living together. Children need parents who will provide more than just financial support for them. Children generally do best after their parents’ separation if they have a mother and father who are both involved in their lives and who can cooperate together as parents even if they are unable to live together as partners.

Arguments about money, or concerns about the fairness of the Child Support Scheme, can get in the way of that cooperation. The overriding goal of this Review of the Scheme has been to ensure that, as far as possible, the Scheme promotes, rather than hinders, the meaningful involvement of both parents in their children’s lives unless this is contrary to their best interests.

1.4 Explanation of terminology

The terms ‘residence’ and ‘contact’ have been in use in family law since 1995 for orders in relation to parenting. The House of Representatives Standing Committee on Family and Community Affairs, in its report Every Picture Tells a Story (December 2003), proposed a number of reforms to the Family Law Act 1975, including replacing the language of residence and contact with family friendly terms such as ‘parenting time’ (Recommendation 4). It is anticipated that changes in terminology will result from the proposed reforms, to be given effect in a Bill not available at this time. In this Report, the Taskforce uses the existing terminology in the absence of any readily substituted terms.

In this Report, the term ‘resident parent’ is used to mean the parent with whom the child generally lives, and ‘non-resident parent’ is used to mean the parent who has periodic contact with the child. Where care is being shared more or less equally, the term ‘shared care’ is used. For the purposes of the recommendations of the Taskforce, ‘regular contact’ and ‘shared care’ are given precise definitions. These are explained in Chapter 9 of the Report.

The Evolution of the Child Support Scheme

The Child Support Scheme grew out of concerns about the poverty of women and children following separation and divorce and about the increasing government expenditure required to maintain children where their absent parents were not making an appropriate contribution to their upkeep.

The issue of poverty in sole-parent households

It has been estimated that, between the years from 1972–73 to 1985–86, the proportion of children living in poverty increased from 7.2% to 17.5%. This increase was partly due to the rising number of sole-parent households (from 9.2% of all families with dependent children in 1974 to 14.4% in 1985), who tended to be fi nancially disadvantaged in comparison with two-parent families.

Increasing marital breakdown was responsible for much of the rise in sole-parent households. Following the commencement of the Family Law Act in 1975, the number of divorces increased from about 17,000 per year to about 45,000 per year before falling and stabilising at about 39,000 from the mid 1980s. While the rate of births outside marriage also increased over this time, 1982 Australian Bureau of Statistics data showed that around two-thirds of sole-parent households had been formed through divorce (37%) or separation (30%).

In its 1986 study of the financial consequences of divorce, the Australian Institute of Family Studies (AIFS) found that women with children who did not repartner suffered the greatest losses from marriage breakdown. Concern about the ‘feminisation of poverty’, particularly in female-headed sole-parent households, was a signifi cant theme in discussions of the financial outcomes for men and women following separation. Community concern came to focus on the court-based maintenance system, which was perceived as inequitable, inaccessible, and lacking powers of enforcement. Only 30% of non-resident parents were making regular payments and only 26% of sole parent pensioners were receiving maintenance. Average levels of maintenance were inadequate, there was little or no indexation of court orders, and the proportion of the population covered was inadequate, particularly for parents who had never married. In general, the court-based system was seen as being too discretionary and as leading to inconsistent outcomes for people in similar circumstances.

There was also concern about the costs to taxpayers of the growth in the numbers of sole-parent households. Most sole-parent families were at least partially reliant on government welfare payments, and courts tended to award maintenance at levels below the free area (so as not to reduce welfare payments), which effectively transferred obligations to the Government.

During the 1980s, there were several major reports and academic studies addressing the issue of maintenance (child support) in Australia, including:

- Cost of children in Australia (the Lovering Report), AIFS, August 1984;

- A Maintenance Agency for Australia: Report of the National Maintenance Inquiry, AGPS, 1984;

- A paper by Edwards, Harper and Harrison on ‘Maintenance and Maintenance Enforcement’, presented to the Family Law Conference in November 1984;

- Work by the Family Law Council: Maintenance Enforcement in 1985, and Child Maintenance: The Family Law Council Proposal in 1986;

- Settling Up, AIFS, March 1986 (and the work done for its follow-up, Settling Down);

- A paper by Harrison, McDonald and Weston in 1987 on research fi ndings and reform proposals;

- A briefing paper on Child Maintenance Reform developed by the Parliamentary Library Legislative Research Service in 1987; and

- Work by Lee in 1989, providing courts with a benchmark on which to base maintenance amounts.

It was generally agreed that the system was far from perfect, and community consultations also indicated public support for reform.

In October 1986 the Government initiated community consultation following the release of Child Support: A Discussion Paper on Child Maintenance, and in March 1987 the Minister for Social Security announced the implementation of the Child Support Scheme in two Stages.

The Child Support Consultative Group (CSCG), chaired by the Hon. Justice Fogarty of the Family Court of Australia, was set up in May 1987 to advise the Federal Government on a legislative formula for the administrative assessment of child maintenance. The CSCG report, Child Support: Formula for Australia, was presented to the Minister for Social Security in May 1988.

Introduction in 1988 of the Child Support Scheme

The first Stage of the Child Support Scheme commenced on 1 June 1988. Stage One, empowered by what is now the Child Support (Registration and Collection) Act 1988, sought to move the collection and enforcement (but not assessment) of child support away from the courts to an administrative agency. This stage was primarily for those already in the existing (court-based) system. Stage Two then transferred the assessment function to the administrative agency. This Stage was primarily for new clients to the child support system.

Stage One covered children born before 1 October 1989 whose parents separated before that date (unless these children had a sibling born on or after that date, in which case Stage Two applied). Stage Two of the Scheme came into effect on 1 October 1989, empowered by the Child Support (Assessment) Act 1989. This Stage applies to children whose parents separated on or after 1 October 1989, or who were born on or after 1 October 1989, or who have a sibling born after that day.

In Stage One, the Child Support Agency (CSA) was established as part of the Australian Taxation Office. Under the Child Support (Registration and Collection) Act 1988, the Commissioner of Taxation was given responsibility for the collection of periodic child and spousal maintenance, and the power and authority to use collection and enforcement methods similar to those used for the collection and enforcement of income tax. It was envisaged that in most cases payment would be made as automatic deductions from salaries and wages, thus removing many of the difficulties and anomalies associated with the collection and receipt of child support. Child support awards were still assessed by the court, but the Family Law Amendment Act 1987 (amending the Act passed in 1975) asserted the primacy of the financial needs of children over all other considerations bar the basic self-support of parents.

Stage Two introduced the formula to calculate child support liabilities, making such calculation an administrative, rather than judicial, procedure. The formula was based on the recommendations of the CSCG, although not all of its recommendations were accepted. The administrative formula sought to produce much greater certainty and equity for children through equal access to fair, secure and regular child support at a level that represented an appropriate share of their parents’ income. The aim of the CSCG was to design a system that was predictable, accessible, simple, inexpensive, and readily understood. The formula was also intended to be flexible enough to apply fairly to a variety of circumstances.

The underlying philosophy of the Scheme shifted the balance more towards private parental responsibility for the financial wellbeing of children, rather than government-funded programs. One of the foundation principles of the Scheme, for example, was (and still is) that Commonwealth involvement and expenditure be limited to the minimum necessary for ensuring children’s needs are met.

Design of the Scheme

The Child Support Scheme rests on certain principles concerning how the responsibility for providing support and care to biological and adopted children should apply where two parents are not living together. It also expresses a basis for apportioning between the parents and the Government the additional costs faced by families that live apart.

The three most important design features of the Scheme are:

- the use of percentages of the liable parent’s income as the basis for the child support obligation, with the percentages assessed on the principle that a non-resident parent should contribute a similar amount to that contributed in an intact family;

- the modification of that principle by use of an exempt amount for the liable parent’s own self-support; and

- the disregard of the resident parent’s income except to the extent that it exceeds average weekly earnings.

The CSCG also gave a great deal of attention to the definition and identifi cation of income and financial resources for the purposes of the Scheme.

The continuity of expenditure principle

The Australian Scheme, as proposed by the CSCG in 1988, was based upon a principle which has been influential in the development of child support policy in the United States and in other countries. This approach is known as the ‘continuity of expenditure’ principle. It was explained by the CSCG in this way:

As a starting point in considering what proportion of income should be shared, the Consultative Group accepted the proposition that wherever possible children should enjoy the benefit of a similar proportion of parental income to that which they would have enjoyed if their parents lived together. This proposition is based on the view that children should not be the economic losers from the separation of the parents or where the parents never lived together.

For this reason, in setting the percentages applicable for the payment of child support, the CSCG drew upon estimates of the percentage of gross income that is spent on children in an intact relationship. The notion underlying the basic formula (where there are no biological children of a second family) is that the liable parent can be expected to continue to contribute out of salary the same proportion as he or she would have contributed had the relationship not broken down. The percentages were based mainly on research from the United States on the share of family income spent on children, although the CSCG also had the benefit of one Australian study.

The continuity of expenditure principle was only a starting point. In determining the percentages applicable in the Scheme, the CSCG had regard to a number of other factors, including:

- additional costs of rearing children where parents do not live together;

- indirect costs of children (cost of care and loss of future earnings);

- access (contact) costs incurred by non-resident parents; and

- community views on what would be a fair level of child support.

The model for the Scheme in Australia was greatly influenced by the work of Irwin Garfinkel and the approach adopted in Wisconsin, U.S.A.This model is known as the percentage-of-obligor-income approach. In Wisconsin, however, there is no self-support component. This is the case also in other jurisdictions that adopt a percentage-ofobligor-income approach.

Exempt income

An important factor modifying the basic principle of continuity of expenditure was the need to ensure that liable parents had enough income for their own support. The CSCG wrote:

However, in designing an appropriate formula it was necessary to temper the application of this proposition in order to ensure a workable scheme and one which took into account the realities of capacity to pay and maintained appropriate incentives to work for both parents […] The recommended formula therefore guarantees the non-custodial parent a protected component of income, the self-support component, on which no child support is levied.

The exempt income amount meant that higher-income non-resident parents paid a higher proportion of their income than lower-income non-resident parents.

The Group proposed also that the exempt income amount should be increased where the liable parent had a second family. The basic aim of the Group was to treat all children of the parties as equitably as possible. In particular, the Group saw no value in transferring hardship to the children in the second family by giving no allowance whatever, whilst recognising that the increased self-support component may have the effect of reserving a greater proportion of a liable parent’s income for their second family, at least for low-income payers. However, the Group felt that it was important to avoid discouraging the formation of new relationships and families. The Group did not give an allowance to a second dependent spouse, except to acknowledge a spouse’s dependence by virtue of responsibility for children by giving a greater increase in the exempt income amount for the first dependent child.

The CSCG was strongly of the view that a parent’s assumed responsibility to a step-child should not take priority over the parent’s responsibility to their own children, except where this responsibility was ordered by a court. The allowances for children in a second family were therefore not extended to step-children.

The resident parent disregard

Another aspect of the Scheme was the resident parent disregard. This is the amount of income a resident parent is allowed before the rest of their income is taken into account in the calculation of the non-resident parent’s child support obligation.

The purpose and level of the disregard was considered closely in the original design of the Scheme. The CSCG noted that there were strong arguments for not taking resident parent income into account in the assessment, particularly that the carer parent is sharing a percentage of their income directly with the child by virtue of having the day-to-day care of the child. It was also noted that the more a resident parent’s income is taken into account, the greater the likelihood that the resident parent will remain on a benefit and not rely on paid employment. However, the CSCG recognised that there would be situations in which the results of not including payee income could be perceived as unfair by the general community. Accordingly, it was determined that payee income would be disregarded unless it was relatively high.

The definition of income

The CSCG originally recommended a very detailed definition of income, going so far as to deal with trusts, private businesses and partnerships, capital gains, and the imputation of income. They were particularly keen to ensure that opportunities for income minimisation were reduced as much as possible, and particularly recommended that any sharing of income with a spouse be undone, treating the income entirely as the income of the liable parent.

These recommendations were not initially implemented. The Government chose to apply the percentages just to taxable income. The availability of other financial resources was dealt with through the grounds for departure from the formula.

Shared care

The CSCG recommended a variation to the formula where the liable parent had care of the children for at least 35% of nights in an annual period. At the outset, the legislation set the threshold for the operation of the shared care formula at 40% of nights. Where care was ‘shared’, the calculation treated both payer and payee as liable in turn, and offset the resulting assessments. The child support percentage used in each calculation was reduced.

Grounds for departure

While the use of a formula was intended to create certainty and consistency, the CSCG was aware of a need to retain the discretionary elements previously applying in the court-based system, yet not to the extent that the advantages of a formula system were undermined by overly broad discretion. The CSCG proposed a court-based change of assessment process, with the court retaining a discretion to depart from the formula on specified grounds. The grounds for departure proposed by the CSCG included:

- high costs are incurred by either parent as the result of the liable parent having contact with the child;

- additional costs exist due to special needs of children in either the carer or liable parent household;

- adjustment is needed for income received by natural or adopted children or by step-childrenin the liable parent’s household, or for income of children received by the carer parent household;

- there are special needs of a spouse which amount to hardship;

- income of new partners may be taken into account where income splitting operates to avoid child support obligations;

- variation is required to exceed the cap where the circumstances justify a greater contribution by the liable parent;

- variation is required to factor in the financial resources of the parties not accounted for in the formula;

- adjustments are required to allow a court to deal with subsequent obligations of a liable parent, where they are now liable to a further carer, a court has imposed a secondary obligation to a step-child or liability for a child is additionally imposed on a step-parent; or

- a reduction in child support obligations exists on a narrowly defined ground of serious hardship or inequity.

The implemented change of assessment grounds drew broadly upon this range of reasons.

Reviews since the Scheme’s commencement

Recognising that neither families nor the world they live are static, the Scheme has been reviewed on several occasions since its inception.

Previous evaluations of the Child Support Scheme, prior to the 2003 Inquiry into Child Custody Arrangements in the Event of Family Separation, include:

- The Child Support Scheme: Progress of Stage 1, CSCG, August 1989;

- Who Pays for the Children? AIFS, 1990;

- The Child Support Scheme: Adequacy of Child Support Coverage of the Sole Parent Pensioner Population, Child Support Evaluation Advisory Group, AGPS, August 1990;

- Paying for the Children, AIFS, 1991;

- Child Support in Australia, Final Report of the evaluation of the Child Support Scheme, Child Support Evaluation Advisory Group, 1991;

- The Family Law Act 1975: Aspects of its operation and interpretation, Joint Select Committee on Certain Aspects of the Operation and Interpretation of the Family Law Act 1992; and

- The Operation and Effectiveness of the Child Support Scheme, The Joint Select Committee on Certain Family Law Issues, 1994 (the Price Committee).

Changes since the Scheme’s commencement

On the recommendation of reviews of the Scheme, the Government has made various changes over the years, resulting in some modification of its operation, although its structure and goals remain essentially unaltered. The major changes are as follows.

Effect of care arrangements

Care and contact arrangements for children have always been factored into the calculation of child support, on the basis that care arrangements affect the contribution to child support required of parents, but as noted above, to begin with shared care was only recognised in the formula where each parent cared for the child for at least 40% of nights (or equivalent care) per year. Where care is ‘shared’, the calculation treats each parent as liable to the other in turn, using an increased exempt amount and reduced percentages. The liability of each parent to the other is offset to find the overall payer.

Since 1 July 1993, a liable parent who has care of the child between 30% and 40% of the nights of the year has an assessment made as for a shared care assessment (each parent treated as liable and the calculations offset), although the percentages applied are different from those applying to parents with more than 40% care, and the parent’s exempt income is not increased from the basic rate without dependants. Generally, the levels of care each parent actually provides for a child are reflected in the assessment.

However, from 1 July 1999, the legislation was amended to reduce any fi nancial incentives the Scheme was creating to encourage parents to breach orders or court-registered parenting agreements. As a consequence, where a parent breaches a court’s parenting order without reasonable excuse, the level of care used in the assessment cannot exceed that set out in the order.

A further change is that, since 1 July 1999, parents can agree that the liable parent has substantial contact with a child, even though the care did not amount to 30% of nights annually.

Prior to 1 July 1999, all changes in care arrangements had effect for the entirety of the financial year to which the assessment applied, both for dates prior to and dates after the date of the change. Often, changes in care notified late in the year resulted in overpayments or debt being created. Since 1 July 1999, a change in care only has effect from the date the Child Support Registrar is notified. However, the care is still calculated over the entire child support period. Past periods of care are factored in when determining whether a change in the level of care has actually occurred such that the assessment should be prospectively amended.

The assessment of income

The income upon which child support was originally calculated was taxable income. Initially, the child support assessment was made for a financial year and was based on the taxable income from the financial year two years previously, inflated by a factor to represent the equivalent income in more current terms.

Since 1 July 1999, the period of a child support assessment is a maximum of 15 months, commencing the month after the making of a tax assessment by the Tax Commissioner for the last financial year. The relevant tax assessment is generally that of the payer. This permits the taxable income from the latest financial year to be used in an assessment as soon as possible after the ending of the financial year, to most closely represent the financial position of the payer.

Since 1 July 1999, supplementary amounts are added on to taxable income, including exempt foreign income and net rental property losses. Reportable fringe benefi t amounts have been included since 1 July 2000. This mirrors social security provisions where such forms of income were generally taken into consideration.

Where a parent’s taxable income was not known, the assessment was originally required to be based upon a default figure equivalent to 2.5 times average weekly earnings. Since 11 December 1992, CSA can choose an appropriate default income where a new assessment must start and taxable income information for the relevant year is not available.

Where a parent’s income situation has worsened (by 15%) since the relevant income period, the parent has an option of asking for the assessment to be based on their estimate of current income. Initially, this was an estimate of income for the full length of the then current financial year (which was retrospective). Such estimates regularly resulted in overpayments. The estimate provisions were changed from 23 December 1997, to allow an estimate for the whole financial year, but then to adjust the income used from the date of the estimate so that the resulting liability for the total year, adding the periods prior to the estimate to those after, resulted in the same rate as though the income for the entire year had been changed. This avoided overpayments in most instances.

Since 1 July 1999, with the advent of variable child support periods not tied to the financial year, estimates have been changed to being a prospective indication of expected annual income, from the date of the estimate. CSA can amend an assessment where the estimate is inaccurate or the income of the parent has changed.

Exempt and disregarded amounts

The exempt amount allowed to the payer and the disregarded amount allowed to the payee were designed with different functions in mind: the exempt amount is meant to prevent the payer (and any second family) from falling into poverty, while the disregarded amount includes the payee’s financial support of the children. This difference notwithstanding, the large disparity in the level of the amounts is one of the features of the Scheme that attracts the most criticism from the public.

Initially, the payer’s exempt income amount was equivalent to the annual amount of the relevant single rate of Social Security pension for the child support year. If the payer had relevant dependent children (that is, biological or adopted children or step-children for whom there is a legal responsibility living with him or her), the exempt income amount was twice the annual amount of the relevant married rate of Social Security pension for the child support year, plus additional amounts for relevant dependent children.

Since 1 July 1999, the payer’s exempt income amount has been increased to 110% of the unpartnered rate of Social Security pension. When the liable parent has relevant dependent children, the exempt income amount is 220% of the annual amount of the partnered rate of Social Security pension, plus additional amounts for relevant dependent children.

The exempt income rules change where the children for whom the assessment is in place are cared for by both the payer and payee (either on a shared basis in some proportion, or because some of the children live with the payee, and some with the payer). Prior to 1 July 1999, the exempt income amount allowed to each parent where both parents care for the child for 40–60% of nights was only that of a parent with no relevant dependants. Since 1 July 1999, additional amounts for the children are added to the single rate of exempt income where parents have care of above 40%.

Prior to 1 July 1999, CSA could include relevant dependent children in a child support assessment from the actual date when they became a relevant dependant. Substantial time could elapse between this date and the parent informing CSA, resulting in overpayments. Since 1 July 1999, the maximum allowable period of backdating is 28 days.

The resident parent’s disregarded income

The payee’s disregarded income was initially the ‘full-time adult weekly earnings’ figure, plus additional flat amounts for childcare for any children under 12. Any excess amounts were deducted in full from the payer’s Child Support Income. The payer’s liability could not be reduced to less than 25% of the assessment that would otherwise have applied.

Since 1 July 1999, the payee’s disregarded income is based on the ‘all employees average weekly earnings’ figure rather than the higher full-time average weekly earnings figure, and extra amounts for childcare costs are no longer added to it. In calculating the amount payable in an assessment, the payer’s income is reduced by 50 cents for every dollar of the carer parent’s income above the disregarded income amount. The payer’s liability can still be reduced by a maximum of 75% by this adjustment. A change of assessment reason allowing a payee to claim high childcare costs was also added.

Consideration of step-children

From 1 July 1999, a payer’s step-child is automatically considered to be his or her relevant dependant if a court has made an order under s.66M of the Family Law Act 1975. Prior to this, the paying parent would need to seek a change of assessment to have a legal duty under a court order to support the step-child taken into account in the assessment. This has not resulted in significant numbers of cases, due to the limited range of eligibility for parents to take advantage of s.66M (which is generally only available in the context of an application for maintenance against a step-parent living apart from the child).

A new change of assessment reason was added from 1 July 2001, allowing a parent to apply for a change of assessment on the basis that they were earning additional income to benefit a child living in their household. The child could be either their biological child or their step-child.

Minimum liability

Initially, where a payer had an income that resulted in a formula assessment of less than $260, the resulting child support liability would be nil. In 1999, a minimum child support liability of $260 was introduced, with few exceptions. This change was designed to reinforce the Government’s view that all parents should contribute financially to the support of their children. There was also a belief that payment of even a token amount would encourage the non-resident parent to be involved with the child, and would instil a habit of payment that could be used to support the children if the payer’s fi nancial situation improved.

Requirement that resident parents seek maintenance

At the inception of the Scheme, any resident parent (payee) in receipt of child support, after becoming eligible for a Commonwealth payment by originally seeking an assessment, could elect to end an assessment at any time. From 6 April 1992, payees in receipt of an income-tested pension, allowance or benefit could not elect to end their assessment. However, such payees could agree with the payer that the amount of the assessment would be nil, effectively getting around the 1992 amendment.

From 29 May 1995, CSA was required to refer a private child support agreement to the Secretary of the then Department of Social Security if the payee received more than minimum family payment or Sole Parent Pension. CSA could then accept these agreements only if the Secretary decided that the agreement passed the ‘reasonable action to obtain maintenance’ test. CSA was required to refuse to accept an agreement if the payee received more than the minimum family payment or Sole Parent Pension and had not applied for a child support assessment.

From 1 July 1999, payees who received more than the base rate of Family Allowance could elect to end their assessment if the Secretary of the Department of Family and Community Services approved. The same rule now applies to parents in receipt of Family Tax Benefit (FTB) Part A. The Secretary must be satisfied that the payee is taking reasonable action to obtain maintenance for the child. In practice, this generally requires that the payee be granted an exemption from reasonable maintenance action. Such exemptions are granted for reasons such as fear of violence and, more recently, well-founded doubts as to the parentage of the child.

Effect of maintenance payments and receipt upon Commonwealth payments

Consideration of maintenance income (including a requirement that resident parents seek maintenance) was introduced in June 1988 with the commencement of the Child Support Scheme. The maintenance income test covered all forms of received maintenance (cash, non-cash and capitalised maintenance). Both child and spousal maintenance were assessed. Maintenance income affected pensions, JobSearch, Newstart Allowance and sickness allowances and special benefi ts. The annual maintenance income free area was converted into a weekly figure of $15 plus an additional $5 per week for a second and each subsequent child dependent on the maintenance recipient. Payments were reduced by 50 cents for each dollar over a maintenance threshold.

With the integration of family payments from 1 January 1993, maintenance income no longer affected income support payments, but it reduced Additional Family Payment. Additional Family Payment and Basic Family Payment were merged in 1996 to form Family Payment, which was then subject to the maintenance income test. With the change to FTB from 1 July 2000, the maintenance income test was essentially retained, with the 50% taper rate applied to income over the maintenance threshold.

Parents paying maintenance could deduct 50% of the amount from family income for the purposes of their receipt of Family Allowance from 1 July 1999. The 50% deduction was retained when FTB was introduced. From 1 July 2001, the deduction was increased to 100% of maintenance paid.

Administrative system for changes of assessment

Although it was the exclusive domain of the Child Support Registrar to make child support assessments for children coming under the legislation, the flexibility of the system was preserved by allowing the Family and Magistrates Courts to depart from the formula in particular circumstances. From 1 July 1992, departure from the formula via an administrative process was established, which was free of charge and for which the parties did not require legal representation. Child Support Review Offi cers assessed applications for administrative departure from the formula, relying on the grounds previously available to the courts.

Payment of child support otherwise than to the CSA

Initially, where the child support liability was registered with the CSA, the Scheme required that payment be made to the CSA. From 1992, this was eased to a limited extent, and CSA could credit an amount as a Non-Agency Payment where the payer made that payment otherwise than to the CSA, although only if both parents intended the payment to be for child support. The provisions additionally required that there be special circumstances.

The requirement for special circumstances was removed from 1 July 1999 along with an easing of the payee parent’s choice to collect the liability privately, and the scope of Non-Agency Payments extended to non-cash payments. Payments were prescribed as payments which may be credited as child support, although only against 25% of the periodic liability.

The Formula for Assessment of Child Support

This chapter explains systematically the current operation of the formula in the Child Support Scheme.

The process

Under the Child Support (Assessment) Act 1989, any eligible separated parent or carer for a child may make an application to the Child Support Agency (CSA) for a child support assessment.43 The previous system of court-ordered maintenance continues to apply to parents not eligible for a child support assessment. This group now represents only 2.3% of CSA’s active caseload.

Primacy of a parent’s responsibility to their own children

The basic child support formula gives priority to a parent’s duty to support their own biological or adopted child over other obligations, such as those to a new partner, step-children, or aged parents, where there is no duty to maintain. Thus only a ‘parent’ of a child within this limited definition is liable to support that child.

The Scheme draws a clear distinction between the legal obligation of a parent to share their income with their own or adopted child or children, and any assumed obligations of the parent. Where a parent has children in successive families, the formula attempts to draw a balance:

the duty of a parent to maintain a child:

- is not of lower priority than the duty of the parent to maintain any other child or another person; and

- has priority over all commitments of the parent other than commitments necessary to enable the parent to support:

- himself or herself; and

- any other child or another person that the parent has a duty to maintain; and

- is not affected by:

- the duty of any other person to maintain the child; or

- any entitlement of the child or another person to an income tested pension, allowance or benefit.

The basic formula

The principal object of the Act is to ensure that children receive a proper level of financial support from their parents.

The current Australian child support formula is based upon a flat percentage of payer income.

The basic formula takes into account the income of each of the parents, the time each spends caring for the child support child or children, and the payer’s obligations to additional children for whom he or she is legally responsible.

The particular objects of the Scheme as set out in the Act include ensuring:

- that the level of financial support to be provided by parents for their children is determined according to their capacity to provide financial support and, in particular, that parents with a like capacity to provide financial support for their children should provide like amounts of financial support; and

- that the level of financial support to be provided by parents for their children should be determined in accordance with the legislatively fixed standards; and

- that persons who provide ongoing daily care for children should be able to have the level of financial support to be provided for the children readily determined without the need to resort to court proceedings; and

- that children share in changes in the standard of living of both their parents, whether or not they are living with both or either of them.

The care of children determines whether a parent is a paying or receiving parent, except for those situations where both parents have significant care.

Definition of income

Income for child support purposes is taxable income with various deductions added back (net rental property losses) and other amounts included (reportable fringe benefi ts and exempt foreign income). This is identical for the payee and payer.

Self-support component

Payer parents

The formula percentages are not applied to income for child support purposes in its entirety, since an amount of the payer’s income is first exempted for the self-support of the individual parent. The exempt income amount is 110% of the unpartnered annual rate of Social Security pension. For 2005, the exempt amount is $13,462.

Carer parents

The income of the carer parent is also taken into account in the current formula. The amount of payee income disregarded is the annual rate of All Employee Average Weekly Earnings as published by the Australian Bureau of Statistics, which includes full-time and part-time employees’ ordinary earnings and ordinary overtime earnings. For 2005, the disregarded amount is $39,312.

Payee income above the disregarded amount (excess income) reduces payer income by 50 cents per dollar of excess income. This has the result that the child support percentage for the payer is applied to a lesser income, and so the obligation is reduced. However, payee income cannot reduce the resulting assessment below 25% of the assessment that would be made without incorporating payee income.

Child support liabilities as percentage of income

Because of the exempt income allowed under the formula for the payer’s self-support, the actual percentage of a payer’s before-tax income paid in child support is lower than the percentages applicable in the formula.

Tables 3.1, 3.2 and 3.3 show the actual percentage of income before and after tax that is taken in child support for one, two and three children respectively, using the current basic formula (payer has no other dependants and any shared care is below 30%) at intervals up to nearly $50,000. $50,000 is about average full-time ordinary earnings in 2004.

| Child Support Income | Liability p.a. | Liability as a % of net income | Liability as a % of before-tax income |

|---|---|---|---|

| $14,820.00 | $260.00 | 1.9519% | 1.7544% > |

| $20,020.00 | $1,180.44 | 6.6931% | 5.8963% |

| $25,220.00 | $2,116.44 | 9.8522% | 8.3919% |

| $27,560.00 | $2,537.64 | 10.9760% | 9.2077% |

| $30,160.00 | $3,005.64 | 12.0515% | 9.9656% |

| $32,240.00 | $3,380.04 | 12.8051% | 10.4840% |

| $35,100.00 | $3,894.84 | 13.7152% | 11.0964% |

| $37,440.00 | $4,316.04 | 14.3696% | 11.5279% |

| $40,040.00 | $4,784.04 | 15.0177% | 11.9482% |

| $45,240.00 | $5,720.04 | 16.1146% | 12.6438% |

| $49,140.00 | $6,422.04 | 16.8002% | 13.0689% |

| Child Support Income | Liability p.a. | Liability as a % of net income | Liability as a % of before-tax income |

|---|---|---|---|

| $14,820.00 | $366.66 | 2.7527% | 2.4741% |

| $20,020.00 | $1,770.66 | 10.0397% | 8.8445% |

| $25,220.00 | $3,174.66 | 14.7782% | 12.5879% |

| $27,560.00 | $3,806.46 | 16.4639% | 13.8115% |

| $30,160.00 | $4,508.46 | 18.0772% | 14.9485% |

| $32,240.00 | $5,070.06 | 19.2077% | 15.7260% |

| $35,100.00 | $5,842.26 | 20.5728% | 16.6446% |

| $37,440.00 | $6,474.06 | 21.5543% | 17.2918% |

| $40,040.00 | $7,176.06 | 22.5266% | 17.9222% |

| $45,240.00 | $8,580.06 | 24.1719% | 18.9656% |

| $49,140.00 | $9,633.06 | 25.2003% | 19.6033% |

| Child Support Income | Liability p.a. | Liability as a % of net income | Liability as a % of before-tax income |

|---|---|---|---|

| $14,820.00 | $434.56 | 3.2625% | 2.9323% |

| $20,020.00 | $2,090.56 | 11.8535% | 10.4424% |

| $25,220.00 | $3,762.56 | 17.5149% | 14.9190% |

| $27,560.00 | $4,511.36 | 19.5128% | 16.3692% |

| $30,160.00 | $5,343.36 | 21.4249% | 17.7167% |

| $32,240.00 | $6,008.96 | 22.7647% | 18.6382% |

| $35,100.00 | $6,294.16 | 22.1641% | 17.9321% |

| $37,440.00 | $7,672.96 | 25.5459% | 20.4940% |

| $40,040.00 | $8,504.96 | 26.6981% | 21.2412% |

| $45,240.00 | $10,168.96 | 28.6482% | 22.4778% |

| $49,140.00 | $11,416.96 | 29.8670% | 23.2335% |

Child support periods

A parent’s capacity to pay is determined by their adjusted taxable income. In order to reflect new taxable income information when it becomes available, child support assessments apply for a ‘child support period’. This period starts when a parent’s tax assessment is available and ends when the next tax assessment is made.

On average, such periods are intended to run for approximately 12 months. However, the 12-month period is not related to the financial year nor to any other period used for other purposes, such as the assessment of eligibility for Family Tax Benefi t (FTB). The assessment is based upon past income year information. If a parent’s circumstances have changed significantly since that year, an application for variation must be made.

The trigger for the new period is the lodgment of a tax return, generally by the paying parent. However, a large minority of child support payers do not lodge tax returns, at least in sufficient time for the child support period to be triggered by the resulting tax assessment. Approximately 44% of child support payers as at June 2004 had not lodged tax returns for the relevant financial year, and so had assessments based on income information other than that shown by the relevant tax assessment. For the four fi nancial years to 2002–03, by 3 December 2004, approximately 52% of payers had lodged all four tax returns. In the absence of a timely tax return, a maximum period of 15 months applies, so that a new period will start in any case, using an income that the Child Support Registrar thinks is appropriate.

Care of children

Care by an entitled carer

The Scheme assumes that a child under the age of 18 is dependent. Where the child is married, or living in a de facto marriage, the child is no longer regarded as requiring support from his or her parents. However, this is the only situation in which the child is defined as independent.

Only a person with care of a child may be the entitled carer under a child support assessment against the parent or parents of the child. The formula takes as a default that the carer is the sole or principal provider of care for the child. However, a parent is entitled to claim child support once they have care of a child amounting to 30% of the nights per year.

Dependants of the liable parent

Care of the child support children by the liable parent, and care of any further biological or adopted children, or step-children for whom there is a legal responsibility, is factored into the assessment. Where the liable parent has responsibility for care of either the child support children or new children, an increased exempt amount is allowed to take account of this. The amount makes no explicit reference to whether the liable parent has a new partner or otherwise. However, the amount allowed implicitly assumes a new dependent spouse. The exempt amount does not take into account the income of any other members of the parent’s household.

For the exempt amount to be increased to reflect a dependent child, the liable parent must have care of the child for 60% or more nights annually. In this case, the exempt amount increases to 220% of the partnered rate of Social Security pension, ($22,480 for 2005) plus additional amounts for children based upon their age:

| Child under 13 years | $2,362 |

| Between 13 and 15 years | $3,296 |

| 16 years and over | $5,109 |

The carer’s disregarded income does not vary with the number of children for whom that parent is caring.

Non-parent carers

Eligibility may be affected where a person is the carer for a child and is not the parent or guardian of that child. Where a parent or guardian lives with the child, although care is provided jointly with another person, the application for support must be made by or on behalf of the parent or guardian. If the carer is not a parent or guardian, the carer is eligible to have child support assessed in their favour unless the parents object to the carer providing such care. Despite parental objection, the carer may still be eligible if it would be unreasonable for the child to live at home.

The incidence of non-parents caring for children has increased, with approximately 1% of families with children now being grandparent families, and 52,100 children living with people who are not their biological or adopted parents. Whilst small in number, the impact of this increasing group within the child support population warrants more consistent treatment by the formula in terms of the treatment of income and refl ection of care by the liable parent.

Minimum and maximum amounts

Minimum liabilities

Since 1999, a minimum liability (of $260 annually, or $5 per week) applies to all liable parents who do not have at least 30% care of a child (that is, to the level acknowledged by the formula). Where the application of the formula results in an annual child support liability that is less than $260, $260 is substituted as the annual rate. The minimum rate can only be reduced to nil by application to the Registrar. The payer must establish that they have access to total financial resources during the child support period of less than $260 in order to have the minimum liability waived.

The minimum liability applies per payer, regardless of the number of children. If the payer pays child support to more than one carer, the $5 rate is apportioned between the carers according to the number of children in their care.

Maximum liabilities

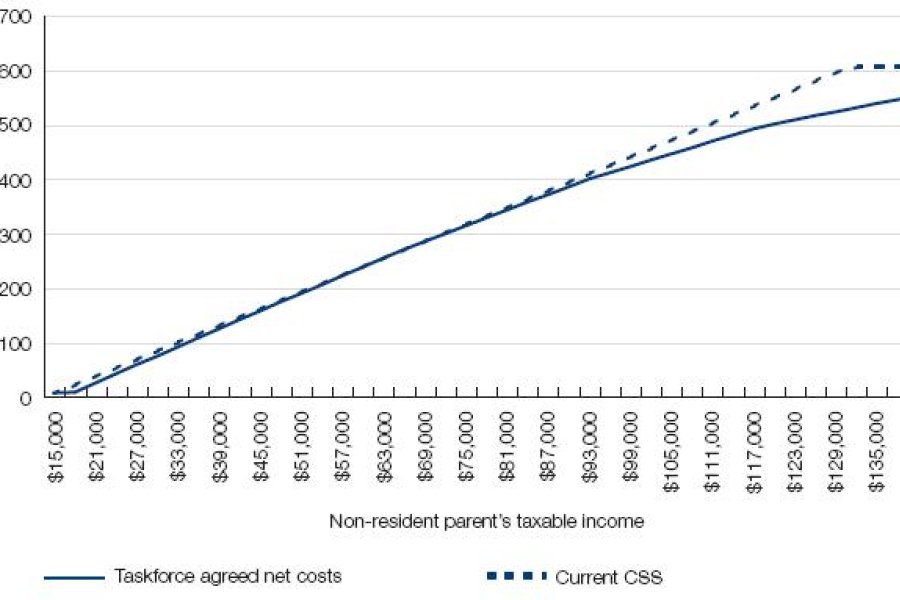

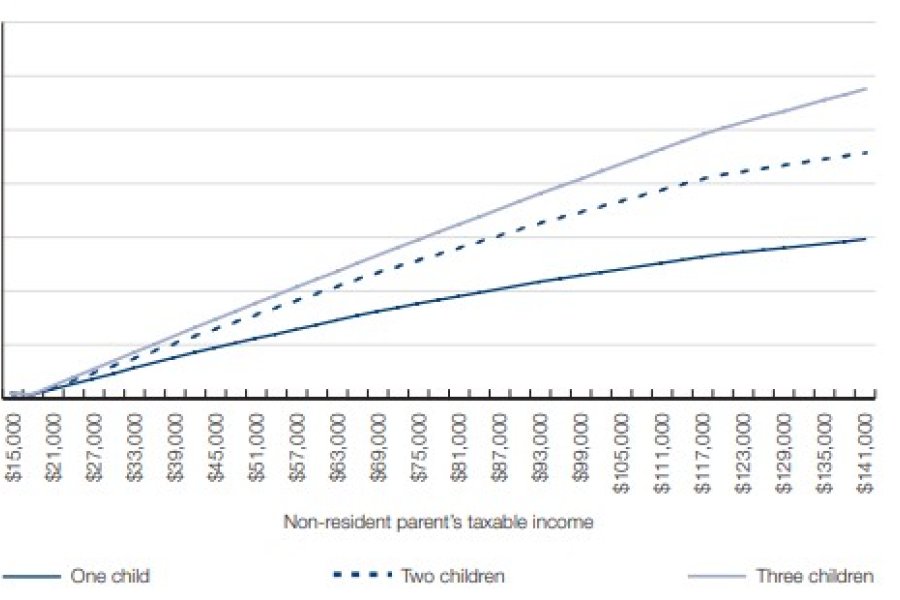

The maximum income on which a liability may be calculated is capped at an annual rate of 2.5 times full-time adult average weekly total earnings, as published by the Australian Bureau of Statistics. Income beyond this level is not subject to the formula. The self-support amount for the individual payer is deducted from the capped income prior to application of the formula. As the level of the cap is related to average weekly earnings, it is automatically updated. The cap for 2005 is $130,767. This produces a maximum child support liability of $21,115 for one child, $31,672 for two children, $37,538 for three children, $39,884 for four children, and $42,230 for fi ve children.

The basic formula in operation

In the simplest of cases, where the child support child lives with one parent, the non-resident parent will be required to pay child support. The liability is a percentage of the liable parent’s taxable income after a self-support component is deducted ($13,462 for a non-resident parent with no dependants in 2005). The percentages are 18% for one child, 27% for two children, 32% for three children, 34% for four children, and 36% for five or more children. The formula reduces the liability of the non-resident parent where the income of the resident parent exceeds the level of average weekly earnings for all employees ($39,312 in 2005).

The formula involves the following steps:

Step 1—Calculate the income for child support purposes of the payer and of the payee.

Step 2—Deduct the applicable exempt amount from the payer’s income, and the disregarded amount from the payee’s income.

Step 3—Subtract 50% of any excess amount of payee income (above the payee disregarded amount) from the payer’s income.

Step 4—Take the applicable child support percentage of the remaining portion of payer income. The child support percentages are:

| One child | 18% |

| Two children | 27% |

| Three children | 32% |

| Four children | 34% |

| Five or more children | 36% |

Step 5—If the resulting liability is less than either of the following, substitute the higher of:

- an assessment amount which is 25% of the amount which would result if payer income was not reduced by payee income with the result of step 3, or

- an annual rate of $260 if the resulting amount is less than $260.

The result of this formula application is the annual rate of child support liability for the child support period.

When the payer has other children to support

Whenever a payer has new biological or adopted children in a second family (or care of child support children), the parent is allowed an increased self-support amount. The child support percentage is then applied to only income exceeding the self-support amount. The result is still checked against the legislated minimum rates.

Payer with children with different carers

Where a paying parent is liable to pay child support to more than one carer, the percentage applied in each assessment is worked out according to the proportion of care each payee has of the total number of children. For example, a payer liable for two children to two different payees will pay 13.5% (half of the 27% applicable to two children) to each payee, not the 18% (applicable to one child) to each payee. The liability to each payee is then calculated separately under the standard formula, using this percentage.

Carers with children of different liable parents

Where a carer has children with different non-resident parents, the liability of each paying parent is calculated separately.

When the child is not being cared for by either parent

Where a child is living with someone who is not their parent, the liability of each parent is calculated separately, subject only to a cap on the combined amounts.

Treatment where both parents have care of their children

Where some of the children live with one parent, but others live with the other parent, the formula treats each parent in turn as liable to the other. The liabilities are offset so that one parent becomes the overall payer.

Shared care

The child support formula changes where there is contact of more than 30%. Where a child’s care is shared between both parents, or each parent has a child living with them, each parent has an entitlement to child support from the other. The calculation of how much each parent has to pay is according to how much care the other parent has. The liabilities are then offset so that only one parent overall is the payer.

Levels of care are generally based on the number of nights each year that a child spends with the parent. Care levels are based on bands, as follows:

| Percentage of care | Nights per year | Assessed care level |

|---|---|---|

| 0–30% | 0–109 | 0% |

| 30–40% | 110–145 | 35% |

| 40–60% | 146–219 | 50% |

| 60–70% | 220–255 | 65% |

| 70%+ | 256+ | 100% |

Parents may agree that the non-resident parent should be considered to provide 35% of care even when the threshold of nights is not reached.

Each parent’s total level of care is calculated by adding together the assessed care percentage for each child support child. For example, a parent caring for one child 35% of the time and another child 55% (treated as 50%) of the time will be assessed as caring for 0.85 children. The other parent’s liability is then calculated by fi nding the relevant child support percentage for this amount of care and applying this to his or her Child Support Income (see below). Where a parent is liable for a ‘part’ of a child, the percentage of income payable is taken from a sliding scale between the percentages for whole numbers of children. For example, a parent liable for 1.15 children has a child support percentage of 20%, which is between 18% for one child and 27% for two. The process is reversed to calculate the second parent’s level of care and the fi rst parent’s liability. The dollar amounts are offset and the balance is payable.

Care of children also determines the exempt amount for each parent, which is subtracted from their total income to give their Child Support Income. The parent’s care of new biological children and of child support children is relevant for this calculation. In these cases, the same rules apply to both parents. In situations where there are different care arrangements for different children, the child for whom the parent has the highest level of care determines the base exempt amount.

| Assessed % of care: | Self-support amount |

|---|---|

| 0 (that is, not shared) | 110% of the unpartnered rate of income support |

| 35 | 110% of the unpartnered rate of income support |

| 50 | 110% of the unpartnered rate of income support plus an allowance for each child |

| 65 | 220% of the partnered rate of income support plus an allowance for each child |

| 100 | 220% of the partnered rate of income support plus an allowance for each child |

The formula steps then become:

Step 1—Calculate the Child Support Income of each parent. If either parent’s income exceeds the cap, the cap is substituted.

Step 2—First, treat one parent as the liable parent, and the other as the payee parent. Deduct the paying parent’s exempt amount from that parent’s income.

Step 3—This step is omitted, that is, the income of the parent being treated as the payee is not applied to reduce the income of the parent being treated as the liable parent.

Step 4—Apply a child support percentage (based upon the care for child support children being provided by the other parent) to the remaining portion of payer income over their self-support amount.

Step 5—Repeat steps 2 and 4, but reverse the treatment of the parents, that is, treat the parent previously treated as the liable parent as the carer parent, and the parent previously treated as the carer as the liable parent.

Step 6—The parent with the higher liability as the result of the previous steps is the paying parent. The liabilities are offset, and the parent with the higher liability is liable to pay the difference between the higher and lower liabilities.

When child support ends

A child support assessment will end when particular specified events occur, including the death of one of the parents or the child, the liable parent moving overseas to a country with which Australia has no reciprocal arrangements, and the child ceasing to be in the care of the carer parent, or reaching the age of 18. Reconciliation of the parents does not end the child support assessment.

The carer parent may elect to end the assessment. However, their entitlement to FTB may be affected if they do so.

Children aged 18 and over

The Child Support Scheme does not currently extend to making an initial assessment for liability for the support of a young person aged 18 or over. Maintenance may be ordered in these cases by a court under the Family Law Act, where continuing support for the young person is needed by virtue of continuing education, disability or other compelling reason. The child support formula is not applicable in such court processes, although a court may have regard to likely formula assessment outcomes when making such determinations.

However, where a child has been the subject of a child support assessment, and is completing their secondary education in the year during which they turn 18, there is facility for his or her parent to seek an extension of an existing child support assessment to the end of the school year.

Variation to assessments

Updating of incomes

Where an assessment is formula based, the level is updated approximately annually by the CSA, either upon the receipt of a new income tax assessment for the liable parent or 15 months after the previous assessment was made, whichever is sooner. If a past assessment was made based upon an income determined by the Registrar (because no taxable income was available), this must be replaced retrospectively (to the start date of the assessment based upon the default income) when taxable income information for the relevant period becomes available.

By contrast, where the Tax Commissioner makes an amendment to a parent’s tax return upon which their child support assessment is based, the change in income will generally not be reflected by a change to the child support assessment, except where there has been tax avoidance.

Estimates of income

The original intention was that the assessment would operate annually, and hence only significant changes would result in a variation of the assessment. However, the original formulation of the Scheme recognised that basing an assessment of liability on a past year’s income could result in significant inequities where current circumstances had changed, and hence there was a need for a mechanism for variation of the assessment in a broader range of circumstances. The current estimation process aims to deal with unexpected changes, such as the loss of a job, and to enable immediate adjustment of the liability to avoid debt. This parallels the way in which the enforcement of court-ordered liabilities for those parents not eligible for child support formula assessment is suspended whilst a parent is in receipt of the full rate of income support. It is not intended to closely track current income and override the use of a past year’s income for standard formula assessments in the way required for income support eligibility.

Estimating income for the purposes of the child support formula now involves a parent applying to have their prospective estimate of current income substituted into the assessment, with the income calculated from the day the estimate is made to the last day of the child support period. The parent’s current income must have decreased by at least 15% from the Child Support Income amount used in the assessment before the parent is eligible to have their assessment based upon their estimate of their current income. However, thereafter a parent may, from time to time, substitute replacement estimates of either decreased or increased income to maintain the currency of the estimate, until the end of the child support period.

Estimates are subject to review by the Registrar where there is information tending to indicate that the estimate may not be correct. The last estimate in a child support period may also be reconciled after the end of the child support period.

The estimate mechanism is used only by individual parents who wish to amend their income details for the purposes of an assessment. Where a parent wishes to change the other parent’s income used in the assessment, they must use the change of assessment process.

Change in care

Each approximately annual child support assessment is made on the basis of each parent’s anticipated care of children for the first 12 months of the child support period. Changes may be reflected in a variation to the assessment, but any variation generally only operates from the time the Registrar is advised of the change of care. The only exception from this is where a parent has ceased to care for a child altogether. Where there has been a change, the ongoing level of care is calculated by taking into account care provided by the parents since the start of the child support period to the date of the change, along with the care anticipated to be provided up to the end of the period. Consequently, only increasingly large variations in care arrangements as the child support period progresses will necessitate an amendment to the assessment, and changes late in the period (particularly towards the end of the child support period) may not result in any amendment.

Agreements

Parents may prefer to substitute their own individualised child support assessment, reflected in a written child support agreement. What an agreement is, how it may be registered and factors relating to variations of agreements are set out in Chapter 13 of this Report.

Changes of assessment

Where a parent believes the formula does not operate fairly in his or her individual case, based upon a limited range of reasons, he or she may apply for a departure from the formula, or change of assessment. Details and some analysis of the reasons, or grounds, upon which departure may be sought are set out in Chapter 12, alongside an explanation of process.

Appeal and review

Internal review

Most decisions of the Registrar are subject to internal review by the CSA (except most decisions about enforcement of child support obligations). A parent seeks internal review by lodging a written objection against a decision, which is then considered by an objections officer (who did not make the original decision). The decision on the objection substitutes for the original decision.

A parent who is dissatisfied with the outcome of the decision on their written objection may then appeal the decision to a court with family law jurisdiction.

External review

Courts with family law jurisdiction may review most child support decisions once they have been reconsidered internally by the CSA. Courts also have original jurisdiction to make orders departing from a formula assessment in some instances.

The parties to an appeal against a CSA decision, and to an application for departure from a formula assessment, are the payer and payee parents. The Registrar is not a party and is not required to justify their decision. However, the Registrar may choose to intervene in a case.

Role of tribunals

Administrative tribunals have only a limited role in the Child Support Scheme. The Administrative Appeals Tribunal (AAT) has a limited role to review decisions about the time within which a parent is permitted to seek internal review by the Registrar of a decision, and about the Registrar’s decisions as to remission of late payment penalties, and penalties for inaccurate parental estimates of income. The respondent to such application is the Registrar, although the AAT will invite the other parent to seek to be a party to the proceedings if the other parent’s rights may be affected by the outcome.

The Interaction of Child Support with Government Payments to Families

The operation of the Child Support Scheme cannot be fully understood without understanding its interaction with the income support system and payments to help families with the costs of children. Of greatest importance is the interaction of child support with Family Tax Benefit (FTB) Part A through the Maintenance Action Test (MAT) and Maintenance Income Test (MIT).

The family payment system

FTB is the centrepiece of family payments as we know them today. The system of family payments comprises:

- FTB Part A, a two-tiered payment linked to the number of children for whom a claimant is responsible;

- FTB Part B, to provide extra help for families with one main income, including sole parents;

- Child Care Benefit, to assist families with their childcare costs;

- Maternity Payment, to assist families following the birth or adoption of a baby; and

- Maternity Immunisation Allowance, to encourage immunisation of children aged 18–24 months.

The FTB Part A rate also comprises several additional components:

- Rent Assistance, for private renters;

- Multiple Birth Allowance, for the birth of triplets or more; and

- Large Family Supplement, for the fourth and subsequent children.

There are also several Australian Government concessions that base eligibility upon qualification for FTB Part A, including:

- the Health Care Card, which provides Commonwealth health concessions such as low-cost medicines under the Pharmaceutical Benefits Scheme, and in some instances concessions on services such as transport, rates and utilities; and

- Medicare Safety Net threshold, assistance for families with out-of-pocket medical expenses, over and above the Medicare rebate.

FTB Part A

FTB Part A is paid at two rates. The base rate recognises the costs of children for all but the highest income parents. It is concerned with what is sometimes called ‘horizontal equity’—fair treatment of people who have similar incomes but different family responsibilities.

Many families with relatively low household incomes are given an additional payment of FTB Part A. This is known as the ‘more than base’ rate. It is provided to ensure that parents on low incomes have enough money to maintain their children adequately. In the income year 2004–05, parents with a household income of less than $32,485 are entitled to maximum rate FTB Part A.

Payments of FTB Part A are for each child and do not take account of economies of scale in raising children. This contrasts with the Child Support Scheme, where there is an assumption, supported by research, that two children cost less per child than one, and that three children cost less per child than two. The current maximum FTB Part A rates are in Table 4.1.

| For each child | Fortnight | Annual |

|---|---|---|

| Under 13 years | $133.56 | $4,095.30 |

| 13–15 years | $169.40 | $5,029.70 |

| 16–17 years | $42.98 | $1,733.75 |

| 18–24 years | $57.82 | $2,120.65 |

Note: Annual rates include the FTB Part A Supplement ($613.20), which can only be paid after the end of income year reconciliation.

Centrelink, A guide to Australian Government payments, 20 March – 30 June 2005, p. 2.

Above an income of $32,485, the rate of FTB Part A declines by 20 cents in the dollar until parents are only entitled to base rate.

| Number of children aged 13–15 years | ||||

| Number of children aged 0–12 years | Nil | One | Two | Three |

| Nil | $48,964 | $65,444 | $81,924 | |

| One | $44,292 | $60,772 | $77,252 | $93,731 |

| Two | $56,100 | $72,580 | $89,059 | $105,539 |

| Three | $67,908 | $84,387 | $100,867 | $117,347 |

Note: Relevant to 2004–05 financial year. Income limit is higher if family is eligible for Rent Assistance.

Centrelink, A guide to Australian Government payments, 20 March – 30 June 2005, p. 2.

The current base rate for FTB Part A is as follows:

| For each child | Fortnight | Annual |

|---|---|---|

| Under 18 years | $42.98 | $1,733.75 |

| 18–24 years | $57.82 | $2,120.65 |

Note: Annual figures include the FTB Part A Supplement of $613.20. This is not included in the fortnightly figure as it can only be paid after the end of the financial year.

Centrelink, A guide to Australian Government payments, 20 March – 30 June 2005, p. 2.

| Number of children aged 18–24 years | ||||

| Number of children aged 0–17 years | Nil | One | Two | Three |

| Nil | $91,092 | $101,519 | $111,946 | |

| One | $89,803 | $100,229 | $110,656 | $121,886 |

| Two | $98,940 | $109,367 | $120,596 | $131,826 |

| Three | $108,077 | $119,307* | $130,537* | $141,766* |

* Income limit is higher than stated for three children aged 13–15 years.

Centrelink, A guide to Australian Government payments, 20 March – 30 June 2005, p. 3.

FTB Part B

FTB Part B provides additional assistance to sole-parent families and two-parent families with one main income. It is based on the age of the youngest child. Unlike Part A, Part B is not paid for each child.

| Age of youngest child | Fortnight | Annual |

|---|---|---|

| Under 5 years | $114.66 | $2,989.35 |

| 5–15 years (or 16–18 years if full-time student) | $79.94 | $2,084.15 |

Centrelink, A guide to Australian Government payments, 20 March – 30 June 2005, p. 4.

For a couple, this payment is not income tested on the higher earner’s income but on the income of the lower income earner. Under the FTB Part B income test, the lower earner can earn $4,000 each income year before the payment is tapered out at 20 cents for each dollar of income. For sole parents, there is no income test.

Splitting FTB

Shared care arrangements can be taken into account for both FTB Part A and FTB Part B. Eligibility for FTB is based on each carer’s household income and individual circumstances.

Introduced in 2000, this provision allows the parents to split FTB on the basis of the number of hours of care provided by each, subject only to the proviso that FTB cannot be paid to a parent who provides less than 10% of the care. By contrast, the child support formula provides for a reduction in child support liability only if the child spends more than 30% of the year (110 nights or more each year) with the paying parent.

The shared care percentage is generally based on the care arrangements in place between the parents, as advised by them to Centrelink/the Family Assistance Offi ce. Where there is parental dispute about the shared care arrangements, the parents are asked in writing to detail the level of care they provide. Where the parties do not agree, they are required to provide additional evidence regarding the actual level of care. Evidence can be a parenting plan, a court order, or any other document to support the actual care given.

Parents with at least 10% but less than 30% care of a child can choose to waive their FTB entitlement for the child in favour of the other parent. A small proportion of FTB customers share their payment. However, this proportion has grown over the last four years or so, even though many separated parents choose not to split FTB despite eligibility to do so.

Overpayments in FTB can occur in circumstances where the parent who receives FTB fortnightly fails to advise of the existence of a shared care arrangement. This happens when another parent claims FTB retrospectively for a period of up to three years. In order to avoid overpayments, all FTB customers are required to advise the Family Assistance Office of any change to their children’s care arrangements.

Interaction of Family Tax Benefit with child support

The Maintenance Action Test

Under the Maintenance Action Test (MAT), most separated people claiming the higher tier of FTB Part A must take ‘reasonable action’ to obtain child support—in other words, to lodge an ‘Application for Child Support Assessment’—and to:

- have the payments collected by the Child Support Agency (CSA); or